Dubai Islamic Bank Group 1st Half 2018 Financial Results

Dubai Islamic Bank (DFM: DIB), the first Islamic bank in the world and the largest Islamic bank in the UAE by total assets, today announced its first half results for the period ending June 30, 2018.

H1 2018 Results Highlights:

Earnings growth driven by strong increase in income from core businesses

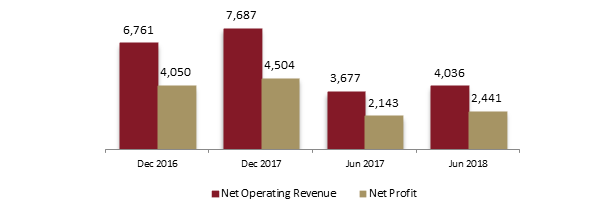

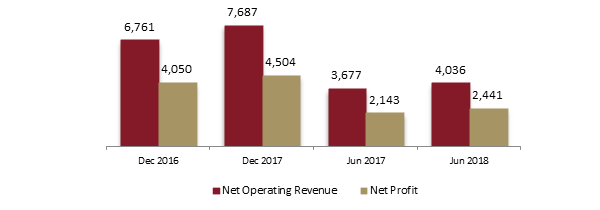

- Group Net Profit increased to AED 2,441 million, up 14% compared with AED 2,143 million for the same period in 2017.

- Total income rose to AED 5,577 million, up 15% compared with AED 4,865 million for the same period in 2017.

- Net Operating Revenue jumped to AED 4,036 million, up 10% compared with AED 3,677 million for the same period in 2017.

- Impairment losses stood at AED 392 million.

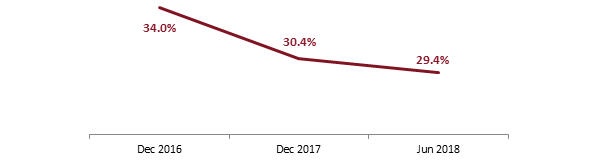

- Efficient cost management continues with cost to income ratio at 29.4%.

- Net funded income margin improved to 3.15%, now at the higher end of the guidance for the year.

Sustained balance sheet growth

- Net financing assets rose to AED 141.8 billion, up by 6%, compared to AED 133.3 billion at the end of 2017.

- Sukuk investments increased to AED 28.4 billion, a growth of 18%, compared to AED 24.0 billion at the end of 2017.

- Total Assets stood at AED 215.6 billion, up by 4%, compared to AED 207.3 billion at the end of 2017.

Asset quality metrics in line with guidance

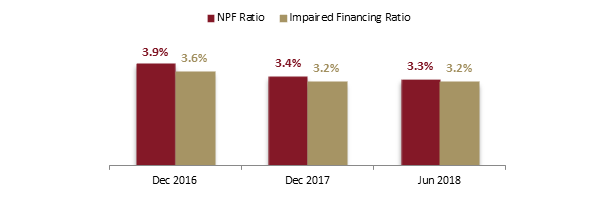

- NPF ratio shows steady improvement now at 3.3%.

- Provision coverage ratio now up to 120%.

- Overall coverage, including collateral at discounted value, stands at 158%, indicating significant cushion in the balance sheet.

Stable liquidity continues to be a critical driver for growth

- Customer deposits stood at AED 151.4 billion as of H1 2018, a rise of 3% from year end 2017.

- Significant CASA proportion, constituting 39% of total deposit base, improved from 37% from year end 2017.

- Financing to deposit ratio stood at 94%, as efficiency buildup continues.

Stronger capital ratios under Basel III following successful rights issuance

- Capital adequacy ratio is at 18.3%, as against 12.4% minimum required.

- CET 1 is at 13.0%, providing significant room for growth under the new Basel III regime.

Focused on long term value to shareholders

- Earnings per share further improved to AED 0.38 in H1 2018 compared to AED 0.33 in the same period.

- Return on assets remained stable at 2.33% in H1 2018.

- Return on equity maintained around 18.8% in H1 2018.

Management’s comments on the financial performance for the period ending June 30, 2018

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

- New initiatives recently announced by the UAE to fuel economic growth across various key sectors look very positive for businesses as well as the financial markets in the coming years

- The roll out of the new capital regulations is another solid step by regulator aimed at boosting the financial strength of the sector as a whole and to safeguard the interest of all stakeholders whilst creating new growth opportunities.

- The tremendous response of the shareholders to the recent capital raising via issuance of rights is a heartening sight for the Board and management. Given the issue was subscribed nearly three times clearly denotes the strong support and confidence the investors have in the franchise.

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

- Our stringent risk management practices and cautious approach towards lending have led to the creation of a franchise far more immune to economic volatility than ever before.

- The bank’s investments in strengthening our digital capabilities continues with our recently enhanced web and mobile platforms aimed at providing our customers with advanced functionalities and delivering a more enriching and user-friendly experience.

- The reaffirmation of DIB’s credit rating recently clearly indicates the robust financial position of the bank across all key financial metrics and ratios.

Dubai Islamic Bank Group Chief Executive Officer, Dr. Adnan Chilwan, said:

- 2018 so far is panning out as planned with expansion across all businesses leading to core income growth as the key performance indicators remain aligned with the guidance.

- Overall income levels continue their northbound trajectory aided by an increase in CASA as well as expansion in net funded margin, the latter having moved towards the higher end of the guidance given earlier.

- Efficiency buildup remains a focus area, a fact clearly evidenced in the trends depicted in key metrics of RoE, RoA and Cost- Income ratios

- With international operations getting fully aligned with the DIB Group agenda, we expect the non-UAE contribution to increase over the years as we continue to spread our proven growth strategy across other markets.

- The recent capital increase has once again created capacity for further growth, allowing us to continue to unlock the potential that the franchise offers both in terms of financial strength and market leadership position.

- The stage is set for another successful year for DIB, and with the foundation laid, we will soon reveal a new direction and an expansionary agenda for the bank which will largely revolve around digitalization directed squarely at changing the way customers interact across the organization with two simple aims – Greater efficiency, Higher returns.

Financial Review

Income Statement highlights:

AED million | Jun 2018 | Jun 2017 | Change (%) |

Total Income | 5,577 | 4,865 | 15% |

Depositors’/sukuk holders share of profit | (1,540) | (1,189) | 30% |

Net revenue | 4,036 | 3,677 | 10% |

Operating expenses | (1,187) | (1,162) | 2% |

Profit before impairment losses and income tax | 2,849 | 2,514 | 13% |

Impairment losses | (392) | (356) | 10% |

Income tax | (17) | (15) | 11% |

Net profit for the period | 2,441 | 2,143 | 14% |

|

|

|

|

Key ratios: |

|

|

|

Net Funding Income Margin % | 3.15% | 3.15% | - |

Cost to income ratio % | 29.4% | 31.6% | (220 bps) |

Return on average assets % | 2.33% | 2.34% | (1 bps) |

Return on average equity % | 18.81% | 18.39% | 42 bps |

EPS (AED per share) | 0.38 | 0.33 | 0.05 |

Total Income

Profitability growth remains on the rise with total income increasing to AED 5,577 million compared to AED 4,865 million for the same period in 2017. The 15% increase was driven primarily by sustained growth in core businesses. Income from Islamic financing and investing transactions increased by 19% to AED 4,415 million from AED 3,713 million for the same period in 2017.

Net revenue

Net revenue for the period ending June 30, 2018 amounted to AED 4,036 million, an increase of 10% compared with AED 3,677 million in the same period of 2017. Commissions and fees increased by 14% in the first half of 2018 reaching to AED 781 million.

Operating expenses

Operating expenses maintained at AED 1,187 million for the period ending June 30, 2018 compared to AED 1,162 million in the same period in 2017. As a result, cost to income ratio significantly improved to 29.4% compared to 30.4% in 2017.

|

Profit for the period

Net profit for the period ending June 30, 2018, rose to AED 2,441 million from AED 2,143 million in the same period in 2017, an increase of 14%. Sustained improvements in profitability continues via the bank’s consistent efforts to push for growth and manage costs across the group.

|

Statement of financial position highlights:

AED Billion |

| Jun 2018 | Dec 2017 | Change (%) |

Net Financing assets |

| 141,836 | 133,334 | 6% |

Sukuk investments |

| 28,448 | 24,023 | 18% |

Interbank placement & CDs |

| 19,418 | 23,681 | (18%) |

Equities & Properties Investments |

| 9,100 | 8,942 | (2%) |

Total Earning Assets |

| 198,803 | 189,980 | 5% |

Cash & Other assets |

| 16,848 | 17,357 | (3%) |

Total assets |

| 215,651 | 207,337 | 4% |

|

|

|

| |

Customers' deposits |

| 151,399 | 147,181 | 3% |

Sukuk Financing Instruments |

| 12,301 | 8,659 | 42% |

Total liabilities |

| 183,205 | 178,456 | 3% |

|

|

|

| |

Shareholder Equity & Reserve |

| 22,467 | 18,592 | 21% |

Tier 1 Sukuk |

| 7,346 | 7,346 | - |

Non-Controlling Interest |

| 2,633 | 2,943 | (11%) |

|

|

|

| |

Total liabilities and equity |

| 215,651 | 207,337 | 4% |

|

|

|

|

|

Key ratios: |

|

|

|

|

Net Finance to customer deposit |

| 93.7% | 90.6% | 310 bps |

Tier 1 ratio |

| 17.0% | 16.0% | 100 bps |

CAR |

| 18.3% | 17.2% | 110 bps |

NPF ratios |

| 3.3% | 3.4% | 10 bps |

Coverage ratio |

| 119.5% | 117.9% | 160 bps |

Financing portfolio

Net financing assets grew to AED 141.8billion for H1 2018 from AED 133.3billion at the end of 2017, an increase of 6% as the bank continues its strong growth on the franchise. Corporate banking financing assets grew at nearly 10% to AED 98 billion whilst consumer business remained steady at AED 40 billion, supported by new financing of over AED 1.2 billion. Commercial real estate concentration remained at around 19%.

|

Asset Quality

Non-performing financing ratio and impaired financing ratio improved to 3.3% and 3.2%, respectively, highlighting the quality of new underwriting. Cash coverage for the period ending June 30, 2018 stood at 120% compared with 118% at the end of 2017. Overall coverage ratio including collateral at discounted value reached 158% compared to 157% at the end of 2017.

|

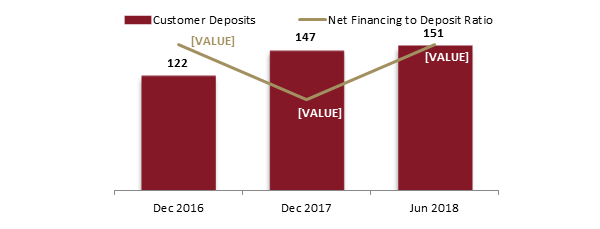

Customer Deposits

Customer deposits for the period ending June 30, 2018 increased by 3% to AED 151 billion from AED 147 billion as at end of 2017. CASA component increased to AED 59.2 billion as of June 30, 2018, as the drive to enhance the low cost deposit base continues. Financing to deposit ratio stood at 94% as of June 30, 2018.

|

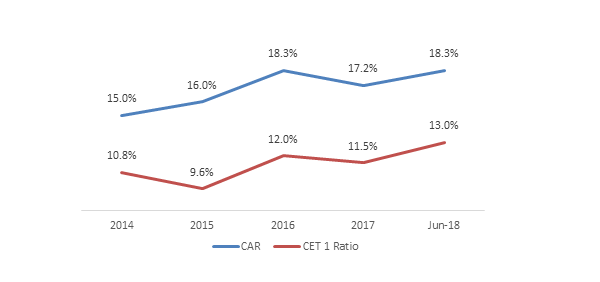

Capital Adequacy

Capital adequacy ratios remained robust, with overall CAR at 18.3% as of June 30, 2018 and CET 1 ratio at 13.0%. The successful rights issuance boosted the bank’s core capital metrics with the transaction generating massive interest across a highly diversified local and international investor base.

|

* Above graph reflects amended prior year values under the new Basel III regime

Ratings:

| Long Term Rating | Outlook | Date |

Moody’s Investor Service | A3 | Stable | June 2018 |

Fitch Ratings | A | Stable | June 2018 |

Islamic International Rating Agency (IIRA) | A/A1 | Stable | November 2016 |

- June 2018 – Fitch Ratings has affirmed Dubai Islamic Bank (DIB) Long-Term Issuer Default Rating (IDR) at ‘A’ with a Stable Outlook and Viability Rating (VR) at ‘bb+’ reflecting strong domestic franchise, healthy profitability and sound liquidity

- June 2018 – Moody’spublishes noteon successful DIB rights issuance indicating that the capital increase is credit positive for the bank and will support the bank’s liquidity, solvency as well as maintain strong and stable capital buffers over the medium term.

Q2 2018 - Key business highlights:

- DIB concluded its Rights Issuance during the quarter successfully raising 1.6 billion additional shares to enhance the bank’s capital and continue to support on its growth plans. The transaction generated massive interest with subscriptions crossing AED 14 billion clearly denoting the huge interest from local and international investors in one of the fastest and most profitable banks in the region.

- An enhanced website platform was launched providing consumers with a more enriched and superior experience in accessing the banks products and services. In addition to enjoying a simplified layout, the site also offers advanced functionalities supported by the latest technology to deliver a more intuitive and user-friendly experience.

- The bank continues its strategy of spreading awareness and leading Islamic finance beyond UAE with participation in key summits and business forums in Tatarstan, Kazakhstan and Indonesia during the quarter.

Year to Date key deals

SUKUK | ||||

Issuer / Obligor Name | Issuer Type | Profit Rate (%) | Amount Issued (USD mn) | Maturity |

Noor Bank | Financial Institution | 4.471 | 500 | 24 Apr 2023 |

Sharjah Islamic Bank | Financial Institution | 4.231 | 500 | 18 Apr 2023 |

DAMAC Real Estate Development Limited | Corporate | 6.625 | 400 | 18 Apr 2023 |

Emirates | Corporate | 4.500 | 600 | 22 Mar 2028 |

Dar Al-Arka | Corporate | 6.875 | 500 | 21 Mar 2023 |

Government of Sharjah | Sovereign | 4.226 | 1,000 | 14 Mar 2028 |

Republic of Indonesia | Sovereign | 5yr: 3.750 (Green Sukuk) | 1,250 | 01 Mar 2023 |

10yr: 4.400 | 1,750 | 01 Mar 2028 | ||

Dubai Islamic Bank | Financial Institution | 3.625 | 1,000 | 06 Feb 2023 |

CLUB/SYNDICATED TRANSACTIONS | |||

Obligor Name | Obligor Type / Sector | Total Amount (USD or USD eqv. in mn) | Signing Date |

Emirates International Telecommunications | Corporate | 615 | May 2018 |

Al Baraka Turk | Financial Institution | 319 | April 2018 |

Meydan Group | Corporate | 350 | April 2018 |

Dubai Properties Lands | Corporate | 104 | March 2018 |

NBB Group | Corporate | 150 | March 2018 |

Ajman Bank | Financial Institution | 200 | March 2018 |

Investment Corporation of Dubai | Quasi-Sovereign | 1,200 | March 2018 |

Tecom Investments | Corporate | 165 | January 2018 |

2018 Industry Awards

Date | Award Giving Body | Award Received |

May 2018 | MEA Markets - 2018 UAE Business Awards | The Bank of the Year 2018 |

May 2018 | BME Industry Awards 2018 | Best Islamic Bank |

May 2018 | BME Industry Awards 2018 | Best Islamic Retail Bank |

May 2018 | BME Industry Awards 2018 | Best Islamic Corporate Bank |

May 2018 | BME Industry Awards 2018 | Best Sukuk Arranger |

May 2018 | BME Industry Awards 2018 | CEO Award – Excellence in Global Islamic Finance and Banking awarded to Dr. Adnan Chilwan |

May 2018 | Forbes Middle East | Dr. Adnan Chilwan amongst "Top Indian Leaders in the Arab World 2018" |

April 2018 | Alleem Project Management Award 2018 | Project Finance of the Year |

April 2018 | Global Finance – 25th Annual Best Bank Awards 2018 | Best Islamic Trade Finance Provider 2018 |

April 2018 | Dubai Service Excellence Scheme | The Widest Implementation of Happiness Meter |

April 2018 | Top CEO Awards - TRENDS magazine in conjunction with INSEAD Business School | Dr. Adnan Chilwan ranked 3rd highest CEO amongst top 100 CEOs in the GCC Region |

April 2018 | Banker Middle East Product Awards 2018 | Best Co-branded Credit Card – DED-DIB Consumer Card |

April 2018 | Banker Middle East Product Awards 2018 | Best Call Centre |

April 2018 | Banker Middle East Product Awards 2018 | Best Home Finance - Al Islami Home Finance |

April 2018 | Banker Middle East Product Awards 2018 | Corporate Deal of the Year |

March 2018 | Islamic Finance News (IFN) polls 2017 | Oman Deal of the Year |

March 2018 | Islamic Finance News (IFN) polls 2017 | Mudarabah Deal of the Year |

March 2018 | Islamic Finance News (IFN) polls 2017 | Real Estate Deal of the Year |

March 2018 | Islamic Finance News (IFN) polls 2017 | Bahrain Deal of the Year |

March 2018 | Islamic Finance News (IFN) polls 2017 | Regulatory Capital Deal of the Year |

March 2018 | Islamic Finance News (IFN) polls 2017 | UAE Deal of the Year |

March 2018 | Islamic Finance News (IFN) polls 2017 | Syndicated Deal of the Year |

March 2018 | Islamic Finance News (IFN) polls 2017 | Deal of the Year |

March 2018 | Islamic Finance News (IFN) polls 2017 | Best Islamic Bank for Treasury Management |

March 2018 | Islamic Finance News (IFN) polls 2017 | Most Innovative Islamic Bank |

March 2018 | Islamic Finance News (IFN) polls 2017 | Best Islamic Bank in the UAE |

March 2018 | Islamic Finance News (IFN) polls 2017 | Best Overall Islamic Bank |

February 2018 | EMEA Finance Middle East Banking Awards 2017 | Best Sukuk House |

February 2018 | Service Olympian Awards 2017 | Best Branches |

February 2018 | Service Olympian Awards 2017 | Best Customer Experience Measurement |

January 2018 | International Finance Magazine Awards 2017 | Fastest Growing Bank in the UAE |

Background Information

Dubai Islamic Bank

Since its formation in 1975 as the world’s first full-service Islamic bank, Dubai Islamic Bank has established itself as the undisputed leader in its field, setting the standards for others to follow as the trend towards Islamic banking gathers momentum in the Arab world and internationally.