Central bank may raise Morocco interest rates for fourth time in a row

ALBAWABA – Morocco is expected to increase interest rates for a fourth straight quarter, according to Bloomberg, in an attempt to curb inflation, which remains above the central bank’s target range.

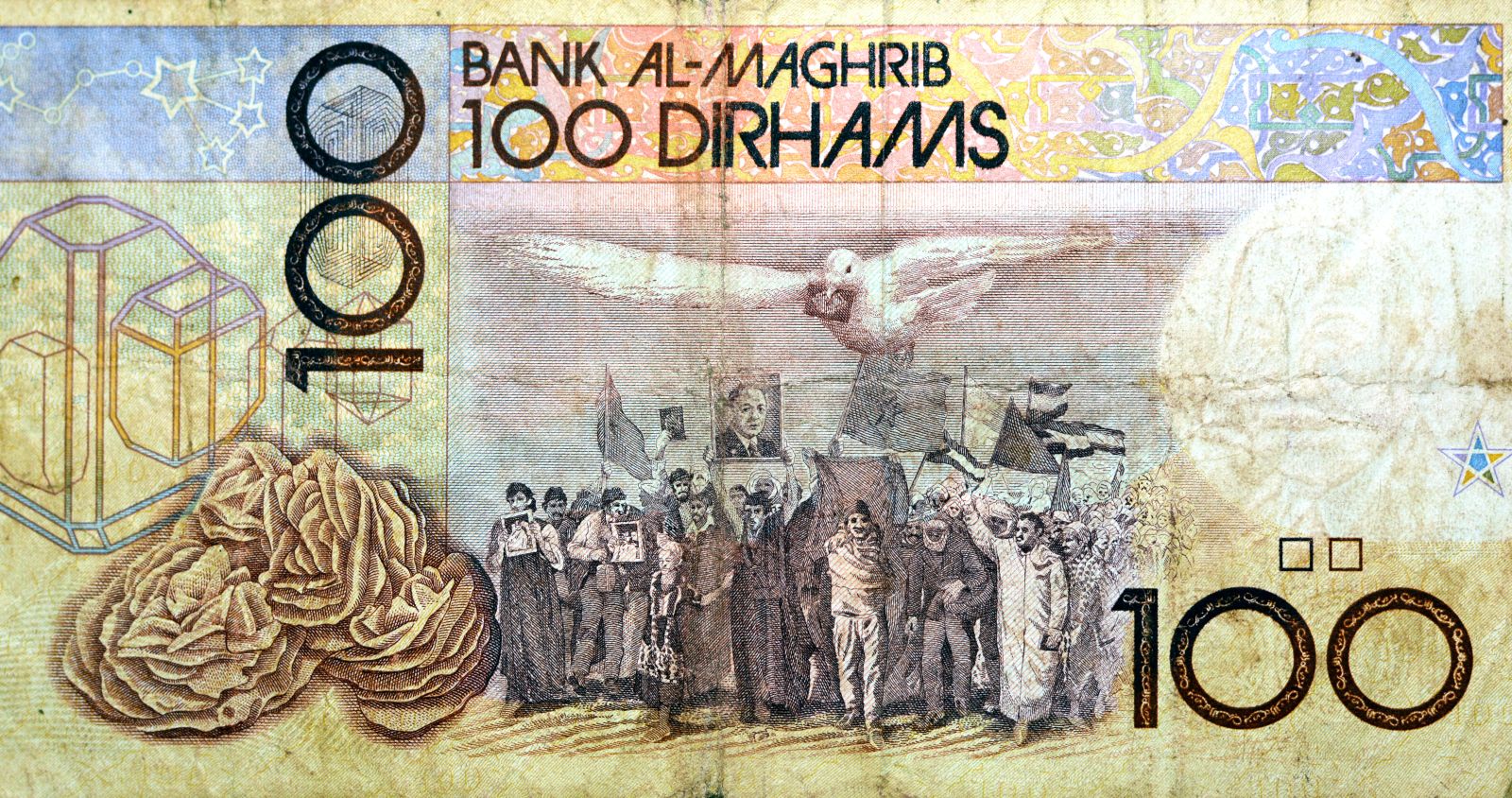

Nearly two thirds of major investors surveyed by Morocco’s biggest lender, Attijariwafa Bank, responded that they expect Bank Al Maghrib to raise the benchmark rate to 3.25 percent.

This would be the fourth hike, this time by 25 basis points, as reported by Bloomberg.

Analysts at Bank of Africa’s BKGR have also made similar assessments, predicting a hike of the same size, the New York-based news agency reported.

This would be the first time the central bank embarks on such a campaign for a full year since the bank gained independence over monetary policy in 2006.

“Bank al-Maghrib should maintain its restrictive monetary policy in order to meet its inflation target” of 5.5 percent in 2023, BKGR analysts told Bloomberg.

Inflation eased to a little under 8 percent in April, from more than 10 percent in February, at the time of the latest hike.

Food prices are surging as the country’s economy was hit by several frequent droughts, noting that Morocco relies heavily on agriculture, economically speaking.

Additionally, Bloomberg explains that the war in Ukraine has also contributed to inflation with higher energy costs.

Meanwhile, wage hikes have not been enacted in Morocco, as authorities toughen their stance on protests, having banned a major trade union from taking to streets earlier in June.